Asahi Kasei, a diversified global company operating across the Healthcare, Homes, and Material sectors, has announced a major step in its ongoing portfolio transformation strategy with the divestiture of Daramic, its lead battery separator business. The company confirmed that it has completed the transfer of Daramic to Kingswood Capital Management, LP, with the transaction officially closing on December 1, 2025. According to Asahi Kasei, the impact of this divestiture on its consolidated financial forecasts for fiscal year 2025 will be minimal, underscoring that the decision was made primarily for strategic rather than financial reasons.

The sale of Daramic marks a significant milestone in Asahi Kasei’s efforts to reshape its business portfolio to align more closely with long-term growth priorities and evolving market dynamics. As industries worldwide undergo rapid shifts—driven by technological innovation, electrification, sustainability demands, and changing consumer expectations—Asahi Kasei is intensifying its focus on sectors that promise robust growth and higher value creation. This strategic repositioning is aimed at improving capital efficiency, enhancing overall profitability, and reinforcing the company’s competitive strengths in areas with substantial future potential.

In discussing the importance of the divestiture, Hideyuki Yamagishi, Primary Executive Officer of Asahi Kasei Corporation and President of the Material Sector, emphasized the company’s forward-looking vision. “As we enter a new era for our company, it is critical that we align our resources with areas that will drive future growth,” Yamagishi stated. “This divestiture represents a strategic step that allows Asahi Kasei to evolve its capabilities with high-potential initiatives, such as strengthening our electronics business and expanding our lithium-ion battery separator business in North America, both key drivers of profit growth.”

Yamagishi’s comments highlight the central motivation behind the divestiture: enabling Asahi Kasei to intensify its focus on next-generation technologies and materials, particularly those connected to the rapidly expanding electric vehicle (EV) and energy storage markets. As the global shift toward decarbonization accelerates, demand for advanced battery technologies is rising sharply, making the battery separator field an especially strategic growth area for the company.

Asahi Kasei originally acquired Daramic through its purchase of Polypore International in August 2015. This acquisition provided the company with significant entry points into multiple battery separator markets, including ownership of both the lead battery separator operations under Daramic and the Celgard dry-process lithium-ion battery separator business. While the lead battery separator market has been stable, it lacks the explosive growth potential seen in lithium-ion technologies. Over the past decade, Asahi Kasei has increasingly prioritized lithium-ion-based innovations as part of its long-term strategic transformation.

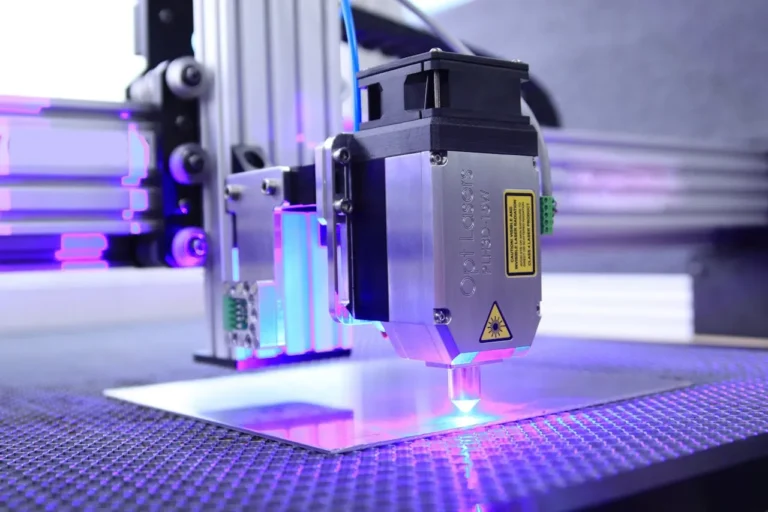

Moving forward after the divestiture, Asahi Kasei plans to strengthen its position in the global battery separator market by concentrating on the development and expansion of its Hipore wet-process lithium-ion separator technology. This technology is a cornerstone of Asahi Kasei’s ambitions in the advanced battery materials space. Known for its durability, high performance, and reliability, Hipore is well-suited to meet the demanding requirements of electric vehicle applications, where battery safety and efficiency are paramount.

The company has indicated that it will focus considerable investment and development efforts on key automotive markets, particularly in North America, Japan, and Korea. These regions are experiencing rapid EV adoption and significant investment in domestic battery manufacturing capacity. The North American market, especially, is expected to see exponential growth due to U.S. policy incentives, expansion of regional supply chains, and heightened demand from automakers seeking domestic sources for critical components. Asahi Kasei’s commitment to expanding its lithium-ion battery separator business in North America is therefore a strategic move to align with customer needs, strengthen supply chain resilience, and participate in one of the most rapidly growing markets for electrification technologies.

Beyond the materials business, the divestiture aligns closely with Asahi Kasei’s broader corporate strategy outlined in its three-year medium-term management plan, titled Trailblaze Together. This plan is designed to accelerate the company’s evolution by improving capital efficiency, boosting profit generation, and converting past growth investments into visible and measurable returns. Central to the plan is the redirection of resources into core growth pillars where Asahi Kasei sees strong competitive advantages and long-term market opportunities.

Under Trailblaze Together, the company is prioritizing four major areas: pharmaceuticals, critical care, overseas homes, and electronics. These sectors represent high-growth domains where the company’s technology portfolio, global reach, and innovation capabilities can produce sustained competitive strength. Structural reforms are also being implemented to streamline operations and ensure that investments are channeled toward the most strategic and profitable initiatives.

The sale of Daramic underscores Asahi Kasei’s willingness to make bold decisions to reshape its portfolio in alignment with its growth strategy. By divesting a mature business that plays a declining role in future energy transitions, the company can redirect capital and management focus toward new technologies with far greater long-term potential. This approach reflects a larger global trend among diversified materials and technology companies that are realigning their portfolios to better address future markets—particularly those linked to sustainability, clean energy, next-generation mobility, and advanced electronics.

In essence, the divestiture of Daramic is not merely a business transaction; it is a strategic pivot that reinforces Asahi Kasei’s commitment to innovation and future growth. With this move, the company is better positioned to invest in high-potential ventures, strengthen its role in the evolving lithium-ion battery ecosystem, and continue delivering value across its global business segments. Asahi Kasei advances its portfolio transformation, the company appears poised to capture new opportunities that will define the next era of energy, mobility, and advanced materials solutions.

Source link : https://www.businesswire.com/