Air Liquide’s Strong Performance in 2024: A Year of Growth and Strategic Investments

Overview of 2024 Performance

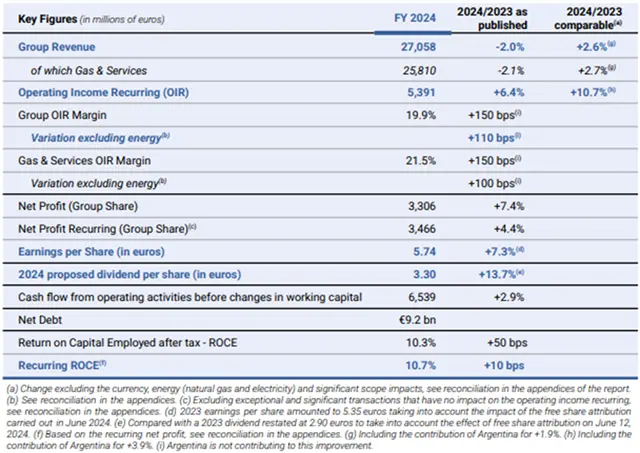

Air Liquide delivered a solid financial and operational performance in 2024 despite a challenging macroeconomic environment. The company achieved a record improvement in operating margins, excluding the energy impact, alongside sales growth on a comparable basis. CEO François Jackow emphasized the strength of Air Liquide’s diversified business model and the agility of its teams as key contributors to this success.

Financial Highlights

- Total Revenue: 27.06 billion euros, marking a +2.6% increase on a comparable basis.

- Gas & Services Revenue: Representing 95% of total sales, this segment recorded steady growth.

- Operating Margin: Improved by +110 basis points, excluding energy impact.

- Net Profit: Recurring net profit, excluding currency impact, increased by +11.5%.

- Return on Capital Employed (ROCE): 10.7%, despite increased investments.

- Dividend Proposal: 3.30 euros per share, reflecting a +13.7% increase.

Strategic Investments and Business Portfolio Adjustments

Table of Contents

In line with its growth strategy, Air Liquide continued to refine its business portfolio and made significant investments in various high-potential areas. Key developments include:

- Finalization of the divestiture of operations in 12 African countries on July 22, 2024.

- Governance restructuring to enhance market responsiveness and operational efficiency.

- Major investments in innovative projects supporting energy transition and industrial efficiency.

Sustainability and Extra-Financial Achievements

Air Liquide made substantial progress in its sustainability commitments under the ADVANCE plan:

- CO2 Emissions Reduction: 11% reduction compared to 2020.

- Carbon Intensity: 41% decrease from 2015, surpassing the 2025 target of 30%.

- Diversity & Inclusion: Women now represent 33% of managerial and professional roles.

- Employee Welfare: All employees now benefit from common care coverage, achieved a year ahead of schedule.

Key Industry Developments and Projects

Energy Transition and Industrial Growth

- Low-Carbon Oxygen Production: Air Liquide secured up to $850 million for the largest low-carbon oxygen production project in the Americas, in partnership with ExxonMobil.

- U.S. Expansion: $150 million investment to expand production and pipeline networks, supplying LG Chem’s electric vehicle battery plant in Tennessee.

- Japan Market Growth: New Air Separation Unit (ASU) to support Mitsubishi Materials.

- European Decarbonization Projects:

- €160 million grant for the d’Artagnan CO2 infrastructure project in Dunkirk, France.

- €220 million grant for a carbon capture project with Cementir Holding in Denmark.

- China Expansion: €60 million investment in an ASU in Yantai for Wanhua Chemical Group.

- Copper Industry Support: €100 million investment in ASUs in Bulgaria and Germany for Aurubis AG.

- Innovative CO2 Liquefaction: Air Liquide’s Cryocap™ LQ technology was selected for Stockholm Exergi’s bioenergy project in Sweden.

Renewable and Low-Carbon Hydrogen Initiatives

- Netherlands Hydrogen Projects:

- ELYgator Project – A 200MW electrolyzer for renewable hydrogen production.

- Joint venture with TotalEnergies for a 250MW electrolyzer.

- France Hydrogen Expansion:

- Long-term supply agreement with TotalEnergies’ La Mède biorefinery.

- €50 million investment in Seine Axis for low-carbon mobility.

- Belgium Hydrogen Hub: €110 million EU grant to develop a large-scale hydrogen production and distribution project at the Port of Antwerp-Bruges.

- European Hydrogen Distribution Network: Air Liquide and TotalEnergies announced TEAL Mobility, a 100-station hydrogen refueling network for trucks across Europe.

Electronics Sector Expansion

- U.S. Semiconductor Industry Investment:

- $250 million project in Idaho to supply Micron Technology with high-purity industrial gases.

- $50 million for a Singapore production unit and facility upgrades in the U.S.

Healthcare Sector Growth

- Increased adoption of ECO ORIGIN™, a sustainable healthcare solution, with 20 hospitals and clinics across Europe and Brazil joining in 2024.

Sustainable Development Commitments

- Power Purchase Agreements (PPAs): Over 2,500 GWh of low-carbon electricity secured, reducing CO2 emissions by over 1.2 million tons annually.

- Green Bond Issuance: €500 million raised to finance energy transition projects.

- Renewable Energy in South Africa: Long-term PPAs with Enel Green Power RSA to supply 110MW of renewable electricity to Sasol’s Secunda site.

Financial Performance Breakdown

Air Liquide’s financial performance demonstrated resilience and growth:

- Group Revenue: €27.06 billion (+2.6% comparable growth).

- Gas & Services Revenue: €25.81 billion (+2.7% comparable growth).

- Large Industries: +1.2% growth, supported by new large-scale units.

- Industrial Merchant Business: +1.6% growth.

- Argentina’s Contribution: Accounted for +1.9% of comparable growth.

- Impact of External Factors: Published revenue decreased by -2.0% due to currency (-2.4%) and energy (-2.2%) fluctuations.

Outlook for 2025 and Beyond

With confidence in its continued growth, Air Liquide announced an ambitious margin target for 2025-2026, aiming for a +200 basis points improvement, leading to a total increase of +460 basis points over five years (2022-2026), excluding energy impact. The company expects to sustain revenue growth and further enhance profitability through ongoing strategic investments and technological innovations.

Conclusion

Air Liquide’s strong 2024 performance reflects its resilience, adaptability, and commitment to innovation. With record investments, strategic partnerships, and sustainability achievements, the company is well-positioned to capitalize on future opportunities across industrial gases, energy transition, and high-tech industries. Looking ahead, Air Liquide remains confident in its ability to drive growth and create long-term value for its stakeholders.